Unlock the potential of private equity in decarbonising Asia

Invest in companies at the forefront of the decarbonisation wave, each with the potential for compelling financial returns and carbon reduction outcomes

Introducing Fullerton Carbon Action Strategy

Fullerton Carbon Action Strategy seeks to support the Carbon Net Zero Agenda by investing in companies in Emerging Asia that are at the forefront of decarbonisation.

About the strategy

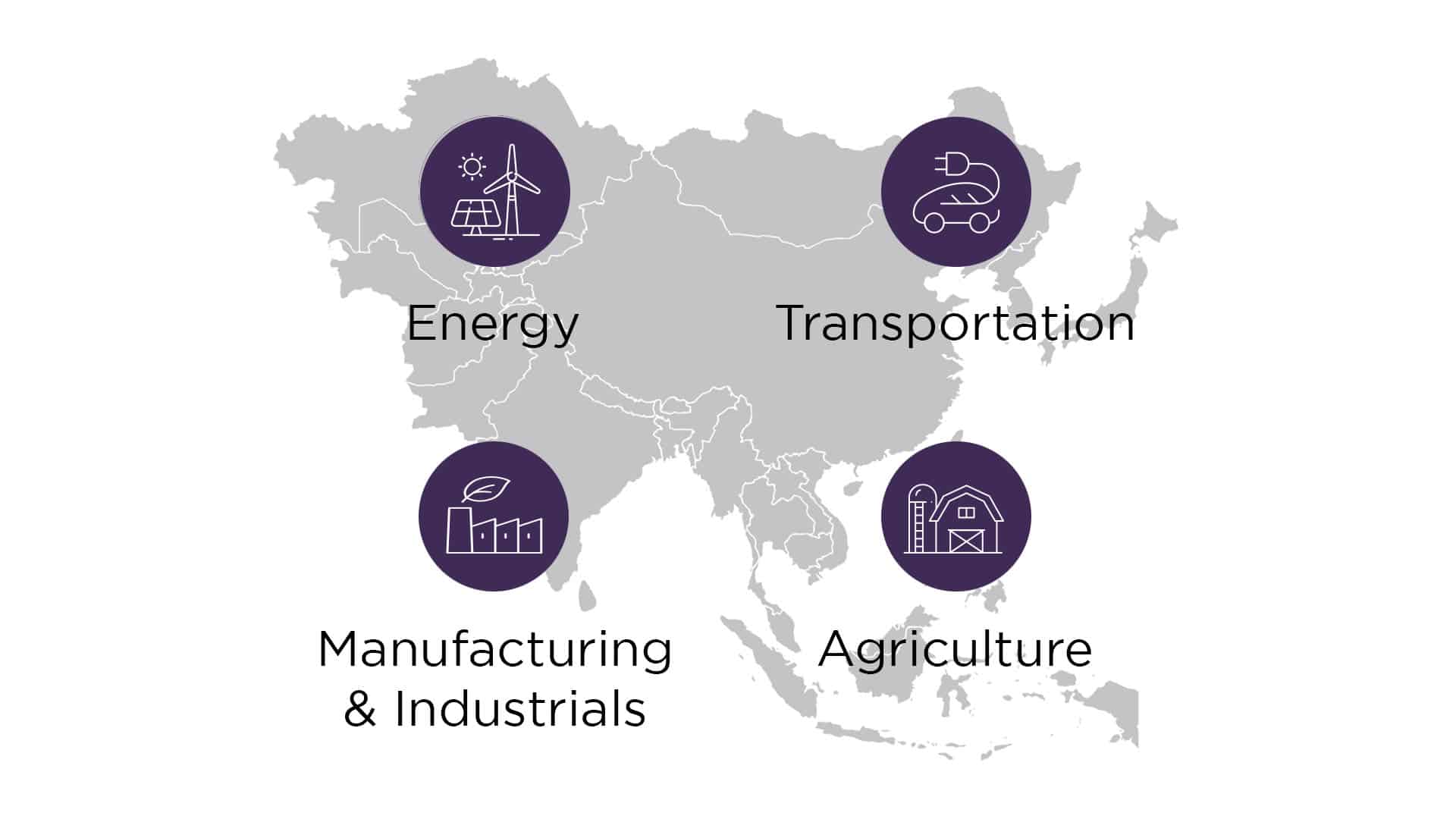

We seek to invest in market leading businesses in the rapidly growing manufacturing, industrials, energy, and electric vehicles/mobility sectors.

Our strategy is to seek out established, profitable and robust cash flow businesses, and avoid earlier stage venture capital investments as well as infrastructure-related deals. These target companies have lower inherent downside risks and are well-positioned to deliver attractive financial returns over the long-term.

Investing in companies at the forefront of Emerging Asia’s decarbonisation

Asia’s undertapped decarbonisation leaders

Invest in companies at the cusp of the decarbonisation wave in Emerging Asia, with potential to deliver significant first-mover upside.

Strategic value creation levers

- We actively engage with portfolio companies, leveraging our deep industry experience and unique heritage to enhance value of our portfolio companies.

- Our expertise positions us uniquely to support these companies in accelerating growth and maximising their potential for decarbonisation.

Our differentiated investment approach

Unique decarbonisation needs require tailored solutions. We work hand-in-hand with our portfolio companies to drive measurable financial returns and carbon reduction outcomes.

Managed by seasoned investment team

- The strategy is managed by Fullerton’s Alternatives team, which senior investment managers boast an average industry experience of 21 years2.

- Its investment approach is underpinned by a proprietary sustainability management framework that seeks to drive significant decarbonisation outcomes in portfolio companies.

1 UNDP does not endorse any entity, brand, product or service

2 As of April 2024

Disclaimer

This publication is prepared by Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and is for your information only. It is not for general circulation and no recommendation is being made to purchase or sell any securities whether referred herein or otherwise. This is not the basis for any contract to deal in any security or instrument, or for Fullerton or its affiliates to enter into or arrange any type of transaction. Any investments made are not obligations of, deposits in, or guaranteed by Fullerton.

Investments have risks and you may lose your principal investment. The value of the investments and any accruing income may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. The contents herein may be amended without notice. Fullerton, its affiliates and their directors and employees, do not accept any liability from the use of this publication.