Executive summary

- Korea is likely to enter a short to medium term period of political uncertainty, until a new President emerges. It is unlikely that President Yoon can continue in his role given the loss of credibility.

- Our positive Asia ex-Japan equities view remains intact. Any adverse impact from Korea’s political uncertainty is likely to be short-lived.

- Korea’s KOSPI index has struggled year-to-date, but earnings growth expectations and equity returns may not undershoot too severely in 2025.

- Its real exchange rate has become more competitive – providing a boost to exporters.

- Korea also still enjoys significant global market share in high-tech industries, machinery, transport equipment, consumer products, and IT, which is unlikely to be thwarted by recent political developments.

Dramatic political turmoil – but positive fundamentals across Asia into 2025 are not expected to be threatened

President Yoon Suk Yeol lurched to the extreme by declaring martial law (the first time since 1980) on his call that it was needed to avert a political crisis and “to protect South Korea’s constitutional order”1. Then just hours later he was forced to backtrack and rescind the declaration when the parliament voted to reject it.

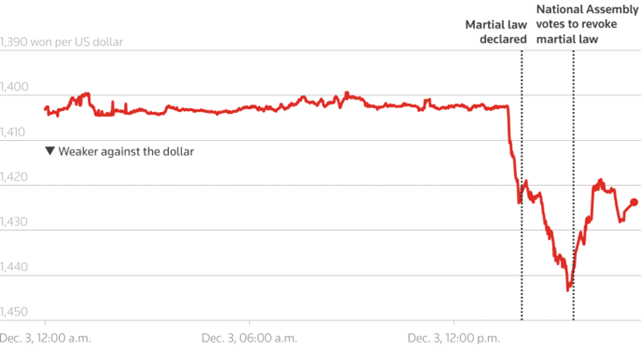

Financial markets reacted in typical fashion to the political event with the KOSPI equity index down around 2% while the South Korean won plunged to a two-year low before rebounding and stabilising (see Figure 1)2. Policymakers were swift and decisive to support financial markets – the Ministry of Finance and the Bank of Korea issued a joint statement that they would inject “unlimited liquidity into equity, bond, and currency markets until they normalise”3.

What is likely to happen next is investors will contemplate how long it will take for a new President to take control. That seems inevitable because after these events, President Yoon will have no credibility nor sufficient populous support to continue. The main government opposition, the Democratic Party, has called for President Yoon to resign or face impeachment (he has been in office since 2022 with a term until 2027). One of South Korea’s largest trade unions has reported that many of its members will consider taking strike action until President Yoon resigns. Before these events unfolded, surveys of his voter support rating were trending at very low double-digits. After these events, many more Koreans will have lost all confidence that President Yoon can run the country and keep it united.

From the historic experience of President Park’s impeachment (Dec 2016), it took 3 months for her removal and thereafter, re-election took place within the statutory 60 days period. On that basis, South Korea could have confidence restored across the voting public with a new President by Q2 2025.

Figure 1: (inverted chart): South Korea’s currency market: a sharp correction and then a rebound toward stability

Source: LSEG and Reuters, 4 Dec 2024. All times are GMT, latest trading data as of 3 Dec 5:17pm GMT.

Fullerton holds a positive outlook on Asia ex Japan equities for 2025

Any negative impacts on South Korea’s financial markets from this political turmoil should be short-lived. What has proved most important is that the actions by policymakers have been swift and so far successful in restoring investor confidence.

However, South Korea’s KOSPI equity returns in 2024 (YTD) have fallen, largely because very strong earnings growth expectations have corrected sharply. The market has struggled with poor performance across the IT sector, but with some offset from financials as the government continues its “value-up” programme4.

We hold a positive outlook on Asia ex Japan equity returns for 2025, where South Korea’s weighting in the MSCI Asia ex-Japan equity index is the fourth largest, behind China, Taiwan, and India, at around a 12% weight (i.e. almost half the weight of Taiwan’s 22%)5. South Korea’s earnings growth expectations and equity returns may not undershoot too far in 2025, because of support from strong US demand as well as from its feeding into supply-chains in China.

In addition, its current real exchange rate is very competitive (on par with China and second only to Japan in Asia), which helps defend market share and profits for exporters. South Korea does enjoy significant global market share in high-tech industries, machinery, transport equipment, consumer products, and IT.

1,2,3 Reuters News, 4 Dec 2024

4 South Korea’s Corporate “Value-Up” program, introduced by the Financial Services Commission (FSC) in Feb 2024, seeks changes in corporate law and regulations to foster a more transparent and fair business environment, improve communication between companies and investors, and ultimately, unlock shareholder value. On “Global Financial Centres Index” rankings, Seoul scores number 5 across Asia, and number 1 by investors for the likelihood that it grows over the next few years. Source: Global Financial Centres Index, 24 Sep 2024.

5 Source: contribution country weights across the MSCI Asia ex Japan equity index, Dec 2024.

Important Information

No offer or invitation is considered to be made if such offer is not authorised or permitted. This is not the basis for any contract to deal in any security or instrument, or for Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) or its affiliates to enter into or arrange any type of transaction. Any investments made are not obligations of, deposits in, or guaranteed by Fullerton. The contents herein may be amended without notice. Fullerton, its affiliates and their directors and employees, do not accept any liability from the use of this publication. The information contained herein has been obtained from sources believed to be reliable but has not been independently verified, although Fullerton Fund Management Company Ltd. (UEN: 200312672W) (“Fullerton”) believes it to be fair and not misleading. Such information is solely indicative and may be subject to modification from time to time.

The audio(s) have been generated by an AI app