Executive summary

- There are alpha opportunities in the SGD credit market worth exploring, which have been largely overlooked by global investors.

- This space offers valuable diversification benefits.

- Historical SGD credit returns have been competitive, with a wide range of issuers in the market.

- There are idiosyncratic traits in SGD credits – like its stable credit spreads which potentially makes it less volatile.

- Actively managing SGD credits requires firm know-how, skill, and experience.

Despite its growing significance, the SGD credit market remains largely under the radar for many global investors. In this article, we aim to de-mystify the SGD credit space by addressing five common myths.

Myth #1: SGD credit returns are low and not worth the effort

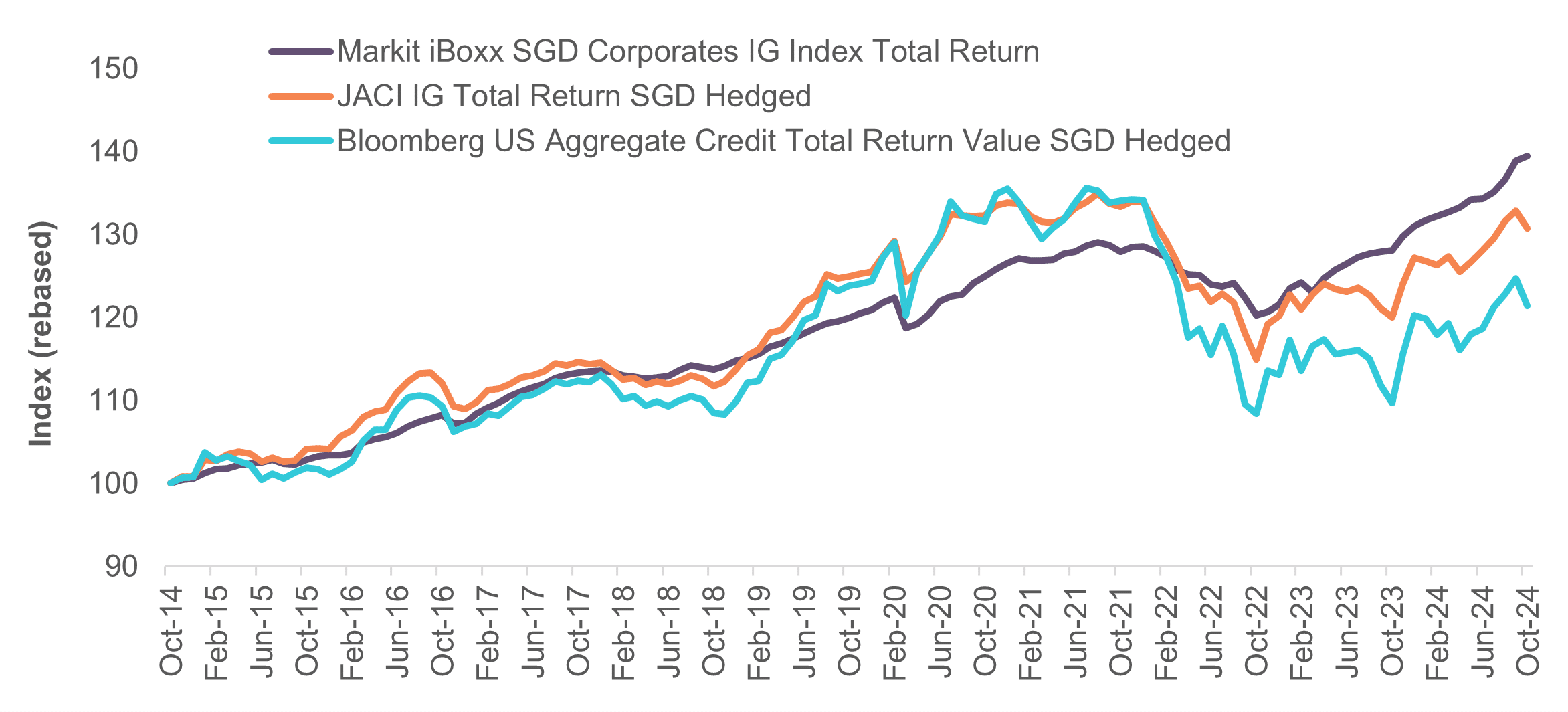

Reality: Contrary to popular belief, SGD credit returns have historically been competitive, even outperforming some larger credit markets. Over the past decade, the SGD investment-grade market has delivered returns that surpassed those of both the U.S. and Asian investment-grade USD credit markets (see Figure 1).

Figure 1: SGD investment grade credit outperformed the Asian and US credit peers (hedged to SGD) over the last decade – 1 Nov 2014 to 31 October 2024

Source: Bloomberg, November 2024. Past performance is not indicative of future performance.

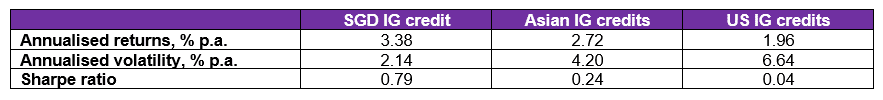

On a risk-adjusted basis, SGD credits present an even more compelling proposition, bolstered by a strong institutional client base that provides market stability. These investors tend to maintain holdings through market cycles, resulting in more stable and less volatile credit spreads—a characteristic that enhances the attractiveness of SGD credit for those seeking resilient returns (see Figure 2).

Figure 2: SGD investment grade credits offer better risk-adjusted returns vs. Asian and US IG credits – 1 Nov 2014 to 31 October 2024

Source: Fullerton Fund Management and Bloomberg, November 2024. Past performance is not indicative of future performance. The indices used to represent SGD IG credit, Asian IG credit, and US IG credit are: Markit iBoxx SGD Corporates IG Index Total Return, JACI IG Total Return SGD Hedged, and Bloomberg US Aggregate Credit Total Return Value SGD Hedged respectively.

Myth #2: SGD credits are only issued by Singapore entities, leading to concentrated risk

Reality: While a significant portion of SGD issuances come from Singapore entities, around 35% of the SGD credit market is comprised of issuers from beyond Singapore1. These include prominent Developed Market financial institutions and key players in sectors such as Asian consumer markets. This diversity broadens investors’ exposure, thereby reducing concentration risk and enhancing portfolio diversification.

Myth #3: SGD credits are only suitable for Singaporean investors

Reality: SGD credits offer valuable diversification benefits to a wide range of investors. The credit spreads in SGD markets are generally more stable compared to USD credit markets, primarily due to the anchor role of institutional investors who adopt a buy-and-hold approach. These investors are typically less reactive to short-term volatility, which reduces price swings, and this enhances market resilience. For foreign investors, there is also a potential yield advantage through hedging, with attractive yield pickup available when converting SGD to USD or AUD, enhancing the potential returns for non-SGD-based investors.

Myth #4: assessing SGD credit risks is straightforward

Reality: The SGD credit market can be quite complex and challenging to navigate due to the prevalence of unrated issuers. It is estimated that more than 50% of SGD credits are not rated by agencies like S&P, Moody’s, or Fitch 2. Without these external ratings, investors must conduct their own credit assessments to gauge risk and determine whether the yields on offer adequately compensate for that risk. This additional complexity means investors need a strong credit research capability to accurately differentiate between investment-grade and high-yield opportunities

Myth #5: SGD credit bonds are easy to acquire in the primary market

Reality: While demand for SGD credit is robust, supply is relatively limited, particularly in the primary market. This strong demand, coupled with a smaller issuance pipeline, means investors often struggle to secure full allocations of favoured issuances and may need to pay a premium in the secondary market.

Fullerton Fund Management: an experienced solutions provider in the SGD credit market

At Fullerton, we are proud to be one of the key providers of SGD-based investment solutions, with a comprehensive suite of capabilities spanning Singapore equity, Singapore rates, SGD cash, and SGD credits.

In the SGD credit space, Fullerton manages flagship funds with over 20 years of robust performance, demonstrating a consistent track record that reinforces our position as an experienced investment manager in the market. Our scale and established presence grants us deep access to the SGD credit market, supported by strong relationships with brokers and comprehensive market coverage.

Moreover, we understand the unique landscape of the largely unrated SGD credit universe, where rigorous credit analysis is essential. Our dedicated sector analysts bring specialised expertise in SGD credits, evaluating issuers with a comprehensive, forward-looking approach. By relying on proprietary research and sector-specific insights, we are able to assess credit risk more accurately and ensure that our portfolios are adequately compensated for the risk assumed. This commitment to diligent credit selection enables us to build resilient portfolios that generate sustainable, and potentially attractive returns for our investors.

1, 2 Source: Fullerton, Bloomberg, based on amount outstanding of SGD credit issuances as of November 2024.

Important Information

No offer or invitation is considered to be made if such offer is not authorised or permitted. This is not the basis for any contract to deal in any security or instrument, or for Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) or its affiliates to enter into or arrange any type of transaction. Any investments made are not obligations of, deposits in, or guaranteed by Fullerton. The contents herein may be amended without notice. Fullerton, its affiliates and their directors and employees, do not accept any liability from the use of this publication. The information contained herein has been obtained from sources believed to be reliable but has not been independently verified, although Fullerton Fund Management Company Ltd. (UEN: 200312672W) (“Fullerton”) believes it to be fair and not misleading. Such information is solely indicative and may be subject to modification from time to time.

All information provided herein regarding JPMorgan Chase & Co. (“JPMorgan”) index products (referred to herein as “Index” or “Indices”), is provided for informational purposes only and does not constitute, or form part of, an offer or solicitation for the purchase or sale of any financial instrument, or an official confirmation of any transaction, or a valuation or price for any product referencing the Indices (the “Product”). Nor should anything herein be construed as a recommendation to adopt any investment strategy or as legal, tax or accounting advice. All market prices, data and other information contained herein is believed to be reliable but JPMorgan does not warrant its completeness or accuracy. The information contained herein is subject to change without notice. Past performance is not indicative of future returns, which will vary. No one may reproduce or disseminate the information, whether in whole or in part, relating to the Indices contained herein without the prior written consent of JPMorgan.

J.P. Morgan Securities LLC (the “Index Sponsor”) does not sponsor, endorse or otherwise promote any Product referencing any of the Indices. The Index Sponsor makes no representation or warranty, express or implied, regarding the advisability of investing in securities or financial products generally, or in the Product particularly, or the advisability of any of the Indices to track investment opportunities in the financial markets or otherwise achieve their objective. The Index Sponsor has no obligation or liability in connection with the administration, marketing or trading of any Product. The Index Sponsor does not warrant the completeness or accuracy or any other information furnished in connection with the Index. The Index is the exclusive property of the Index Sponsor and the Index Sponsor retains all property rights therein.

The source of the JACI Investment Grade Total Return – SGD Hedged Index is J.P. Morgan Securities LLC, the Index Sponsor. Prior to 1 October 2012, the benchmark was computed by the Managers derived from JACI Investment Grade Total Return Index. The source was changed retrospectively from 8 May 2010.

The audio(s) have been generated by an AI app